Blog > When Will Mortgage Rates Go Down?

What Affects Mortgage Rates? Understanding the Key Factors

When you’re buying a home, your mortgage rate is a huge deal—even a fraction of a percent can add up to thousands over the life of your loan. But what causes mortgage rates to rise or fall? Two major factors influence mortgage rates: the broader economy and your financial profile.

🌍 Economic & Market Factors That Influence Mortgage Rates

-

U.S. Treasury Yields

Mortgage rates move in sync with the 10-year U.S. Treasury yield. When the ten-year bond yields climb, mortgage rates follow. -

Federal Reserve Policy

The Fed’s decisions don’t set mortgage rates directly, but when they raise the federal funds rate or stop buying bonds, rates tend to rise. -

Inflation

Higher inflation means lenders demand more interest to keep pace with the shrinking value of a dollar. This is why markets are always listening to what the Federal Reserve is saying. -

Overall Economic Growth

Booming economy? Rates often rise. Slowdown? Rates can fall as investors seek safety and the Federal Reserve makes adjustments to prevent recessions. -

Mortgage-Backed Securities (MBS)

Most loans get bundled into MBS. Investor appetite for these securities impacts what lenders can offer. Pandemic rates were affected by the government's purchase of mortgage-backed securities in the billions, the low risk associated with government-backed loans, which sent rates to historical lows. There is no foreseeable end to this recurring trend. -

Housing Market Demand

High buyer demand can nudge rates up; when demand dips, lenders may drop rates to stay competitive. This is why it’s smart to shop your rate with multiple lenders—comparing loan estimates ensures you get the most competitive rate available, no matter what the market is doing.

👤 Personal & Loan-Specific Factors

-

Credit Score – Higher score, better rate. Some programs require a minimum credit score of 580; higher scores give you more options.

-

Down Payment & Loan-to-Value (LTV) Ratio – Bigger down, lower LTV, lower risk, better rate.

-

Debt-to-Income (DTI) Ratio – Lower DTI = more cushion = lower rate.

-

Loan Term – 15-year loans cost less in interest than 30-year, but have higher monthly payments.

-

Property Type & Occupancy – Primary residences get better rates than rentals or investment properties.

-

Loan Type & Amount – FHA, VA, jumbo, ARM—all carry different risk premiums.

-

Mortgage Points – Pay upfront to lower your rate if you’ll be in the home a while.

-

Lender-Specific Pricing – Every lender’s model is different. Always shop around.

Tips to Secure the Best Rate:

-

Pay bills on time and improve your credit score.

-

Lower your DTI by reducing debt before applying.

-

Save for a bigger down payment.

-

Compare multiple lenders—don’t take the first offer.

-

Watch for Fed and inflation news.

-

Consider a credit repair company to guide you and help ensure success.

The Bottom Line: Buy When You Can Afford and Need a Home

This adage rings true: Don’t wait to buy real estate. Buy real estate and wait.

-

If you need a home and can afford one, that’s the right time.

-

Waiting for “perfect rates” is usually a losing strategy.

-

In real life, it’s the cost of waiting—not just the interest rate—that punishes buyers most.

Remember:

-

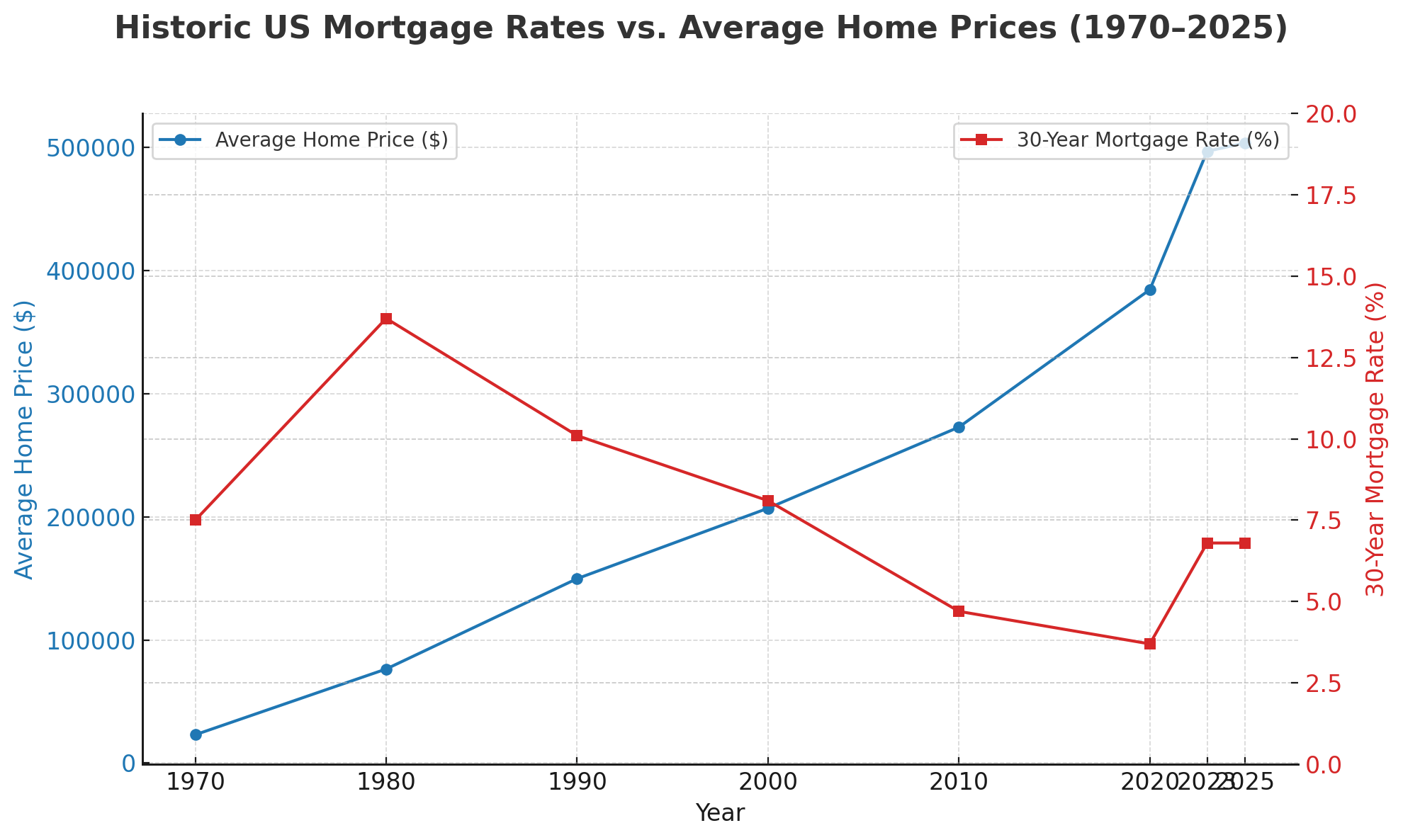

“Normal” mortgage rates are historically closer to 7% than 3%.

-

The price of waiting is almost always higher than the price of acting.

Source: MacroTrends

-

1970s-1980s: Peaked at over 18% during the inflation crisis.

-

2000s: Averaged 5-7%.

-

2020-2021: Pandemic lows around 2.65%.

-

2022-2025: Ranging from 5.5% to 7.5%.

Rates below 4% are a historical anomaly—not a baseline you should wait for.

See more: Freddie Mac PMMS

How Mortgage Rates Affect Your Buying Power

A 1% swing in mortgage rates can significantly impact your home-buying budget.

Example:

-

$400,000 loan at 7% = $2,661/month (principal & interest)

-

$400,000 loan at 6% = $2,398/month

-

That’s a $263/month difference—over $3,100 per year, and more than $31,000 across a 30-year loan.

But here’s where it really matters:

A 1% drop in mortgage rates typically increases your buying power by about 10%.

So, if you could afford a $400,000 home at 7%, you may be able to afford a $440,000 home at 6%—for roughly the same monthly payment. The reverse is also true: if rates rise by 1%, your buying power typically decreases by 10%.

Use our Mortgage Calculator to see exactly what you can afford with today’s rates.

The Domino Effect: Mortgage Rates & Application Volume

When rates ease, buyers flood back in.

-

The Mortgage Bankers Association reported a 9.4% spike in mortgage applications in a single week when rates slipped in July 2025 (MBA Data).

-

The same thing happened in late 2022 and early 2023, with application surges tracking each rate dip (Freddie Mac Historical Data).

Source: MBA Mortgage Application Survey

Refinance activity also jumps, increasing demand and pipeline congestion across the industry.

What Happens Next? Buyer and Seller Perspectives

For Buyers

-

Increased Competition: More buyers means bidding wars and fewer bargains.

-

Timing is Everything: Waiting for rates to fall may mean you pay more for the same house—or lose out entirely.

For Sellers

-

Stronger Demand: Lower rates = more buyers = potentially higher offers and faster sales.

-

Pricing Power: But don’t wait forever—if rates rise or inventory grows, leverage fades.

Conclusion: Life Moves First—Real Estate Follows

Here’s the truth: For most people, the time to buy or sell a home is rarely about catching the market at the perfect moment. It’s about responding to real life—moving out of a rental, getting married, welcoming a child, upsizing for more space, downsizing for simplicity, relocating for a new job, or adjusting to life after a loss.

You can try to delay your move, but you can’t control when life requires a change—or what the economic climate or housing market will look like when that time comes.

That’s why the most brilliant move isn’t about chasing headlines or waiting for predictions to play out. It’s about understanding your own needs, being prepared, and working with a team who gives you honest, data-driven advice.

At Lifetime Client Group, we believe that real estate should serve your life—not the other way around. If you’re considering a move, let’s talk about your goals, your timing, and what’s possible—no hype, just the facts and a plan tailored to you.

Ready for your next chapter? Contact us today and let’s make your move work for you—whenever life says it’s time.